Introduction

In my last article (Applying Asset Concepts to Relationships) I further examined the concept of managing relationships as assets. This time I would like to focus specifically on the management of groups (or portfolios) of these assets. Again, the discussion is solely concerned with relationships that are systemically important for the firm. These are typically found at senior levels of the firm and can be critical for business success and even survival.

How to calibrate a portfolio of relationships

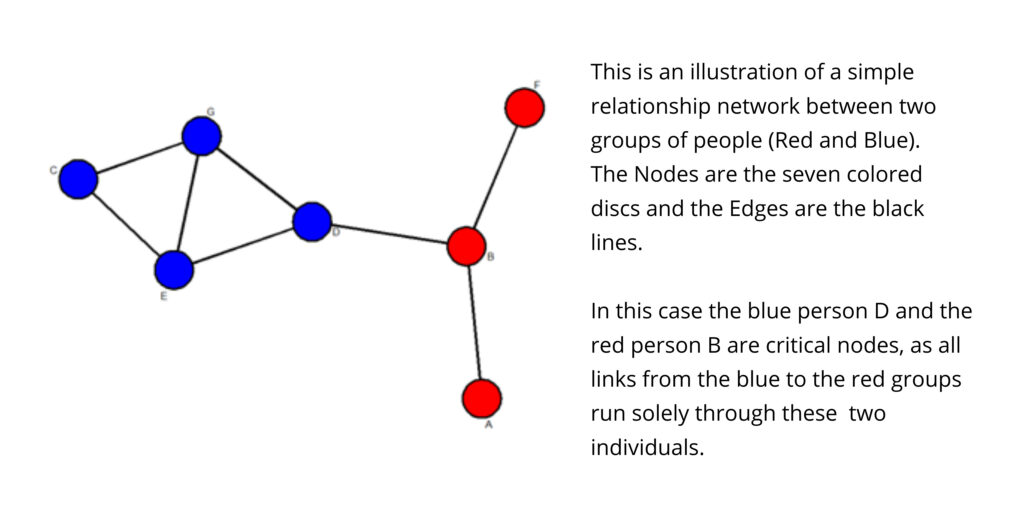

There are two ways to look at a relationship network: you can focus on the individuals involved (person A knows person B) or you can look at the link between the individuals (there is a relationship between person A and person B). This may seem pedantic, but it matters a great deal when considering portfolios of relationships. Using the terminology of Graph Theory (a branch of mathematics) the people are called Nodes and the relationships between them are called Edges (other terms are used, particularly in specific contexts). In graph theory you can carry out an edge-based or node-based analysis on a network, depending on the question under consideration[1].

Take network density, for instance. The key factor here is the number of edges between any given group of nodes as a ratio of the total number of edges possible. So, for instance, in a network of 6 people the density is the number of connections divided by 15, the maximum possible number of connections[2].

In contrast, one of the important measures of a person’s importance in a network is node degree, that is, the number of relationships a person possesses. Assessing this measure can identify where a firm is over-reliant on a small number of key individuals (called critical nodes) for its relationship network. Equally, it can also identify where there is overinvestment in relationships, which can lead to a sub-optimum use of resources.

Clearly, a modern portfolio approach to relationship management needs to consider both of these factors, nodes and edges, in its assessments.

How to manage a portfolio of relationships: internal factors

Having already established an asset register (a list of systemically important relationships, also called the 1st-degree connections), the next step is to assign a strength measure to each. This is not as difficult as it seems, as a simple three or five-level grading is usually sufficient. There are often called “star ratings” as a grading on a one to three (or five) star scale is sufficiently graduated to capture the strength of the relationship without overcommitting resources to this activity[3].

Adding this weighting fundamentally changes the asset register, as what initially seemed to be good coverage of a key company or sector can prove to be much more fragile. Equally, it can identify areas of excessive concentration of strong relationships to the detriment of other areas. In short, it is a crucial step to gap identification. And yet, it is often considered by organizations to be bureaucratic, unnecessary or a nuisance.

Once the relationships have been counted and weighted they can then be bundled into categories. It is here that the concept of graph edge and node measures comes into play.

- Counting the number of relationships each individual holds (node degree) and evaluating their combined strength is crucial to assessing the impact each person has on the overall network density. In less theoretical terms, it addresses the question of whether the firm is over-reliant on one or a small number of highly connected individuals for business-critical relationships, i.e. the network resilience.

- Is the network too dense or too thin (too many or an insufficient number of relationships of the correct strength)? Remember, not allowing for relationship strength may lead to a false sense of security, as apparent backup relationships may not be sufficiently strong to serve the firm’s needs and so may need strengthening.

How to manage a portfolio of relationships: external factors

The next step is to evaluate the external (endpoints) of the relationships. In this case a customer relationship management system (CRM) is a necessary but not sufficient first step. To fully understand the web of relationships surrounding the firm it is necessary to also account for the relationships held by this network. These are referred to as the 2nd-degree connections and indicate how far the firm’s network pushes into the overall business environment.

Here, again, graph theory and an asset orientation concepts help illustrate the issues.

- It is necessary to understand not only the collection of connections held by the firm (addressed in the internal aspects, above) but also the contact’s own relationship network. This is beyond the capability of a CRM and requires a specialist analysis system, such as BoardEx. These use the organization’s internal information and their own proprietary database[4] to map out the 1st and 2nd-degree connection network, and a sophisticated system to weigh the 1st to 2nd-degree relationships (edges) so as to develop a more sophisticated network understanding[5].

- Incorporating the 2nd-degree connections can have a profound impact on the assessment of a relationship. A connection may not be important in their own right but may be a holder of key relationships that greatly increase the relationship reach of the firm (as illustrated in the diagram on the first page). This is a key concept in graph theory and, as such, will be addressed further in a future article.

Relationship portfolio perspectives

Modern Portfolio Theory is financial theory based on a quantification of risk, reward, and correlation between financial assets. While providing a useful template it cannot be translated directly across to the management of relationship assets. Nonetheless, it does provide several useful principles that can be adopted for these purposed.

- Every relationship has a value, and equally carry risk, as discussed in the previous article (Applying Asset Concepts to Relationships). These risks and rewards, however, are not quantifiable in the same manner as financial assets, so the same statistical analysis cannot be carried out.

- These relationships, however, can also be considered to have correlations, although not in the strict statistical sense. The correlation measure here is the likelihood that two or more holders of an important relationship to a given person or organization of importance will leave at the same time. This is not just something that can happen owing to collusion but also, for instance, if a decision is made to close an operation without carrying out a relationship inventory beforehand.

- The overall risks to these important relationships can be reduced by ensuring that there are more than one relationship holder, and that they are not “correlated” by not having them concentrated in one unit or team. This is called diversification in asset management. This diversification can also be considered from a “node” or “edge” perspective – ensuring that relationships are held by more than one person (nodes) or that there is a multiplicity of paths to any important endpoint (edges). This becomes particularly important when evaluating 2nd-degree connections, the links that open up new opportunities. Without building resilience in both nodes and edges it is possible to lose connections should only one or two individuals drop out of a network

- Asset diversification is also achieved by also mixing in different forms of assets. In financial asset management these include property, cash, equities, and bonds. For relationships this asset mix is also important but now it refers to the types of relationships held in the portfolio. These relationships can be put into a few key classes, including:

- Employment – individuals working or having worked together;

- Advisory – individuals having had an advisory relationship e.g. auditor, consultant, lawyer;

- Transactional – having worked on a corporate action together;

- Not-for-profit/charity – having sat on a board or as trustees together;

- Outside body – having served in outside groups (such as professional bodies or institutes) together.

Conclusion

The purpose of this article was to further expand on how an asset perspective can help with the management of relationships. It sought to apply some modern asset management perspectives to relationships and indicate important steps that could be taken to manage these assets. The next articles in this series will look at some specific topics in this area, including the importance of weak connections in relationships and the rate of decay of personal profile databases.

[1] For the theoretically minded, this discussion considers the graphs as “undirected”, that is, the relationship between the two connected individuals is mutual. More sophisticated analyses consider “directed graphs” (also called “digraphs”), which allow for differences in the relationship between two people. This level of sophistication is beyond the scope of this article, although it is found in modern network analysis and management tools, such as BoardEx.

[2] The maximum possible number of connections in such a graph is half the number (n) of nodes times the number of nodes-1, i.e. n(n-1)/2. The division by two is necessary as this is an undirected graph and so the same edge links both people in a relationship.

[3] For instance: 3-star = close friend; 2-star = working relationship; 1-star = acquaintance.

[4] A key factor here is the system’s data quality. This should be accurate and up-to-date, or else the conclusions are likely to be erroneous (e.g. a supposed key contact at a firm may no longer be in its employment).

[5] This requires a directional approach to these networks, and is found in the more sophisticated systems, such as BoardEx.